by J. Chris Brown, Attorney at Law, Babb & Brown, P.C.

An increasing number of seniors are conquering their technology fears and now use computers regularly. A study by Pen Internet and American Life shows six out of 10 adults age 65 or older (20 million American seniors) are online, and seventy percent of these seniors access the Internet daily. Their online habits are similar to the rest of the population – entertainment, accessing healthcare information, keeping in touch with family and friends through email and social media, shopping online, reading news and making business or financial transactions.

While the Internet allows seniors access to a wealth of information, it also makes them susceptible to online scammers. Many seniors have a solid nest egg and excellent credit, making them a desirable target for thieves. Additionally, seniors tend to be more trusting and less-proficient in terms of online risks – they may not know not to click on a pop up or not to reply to a certain email. To further complicate matters, today’s Internet scammers have become very sophisticated, creating websites that look nearly identical to legitimate websites that these seniors may be seeking out.

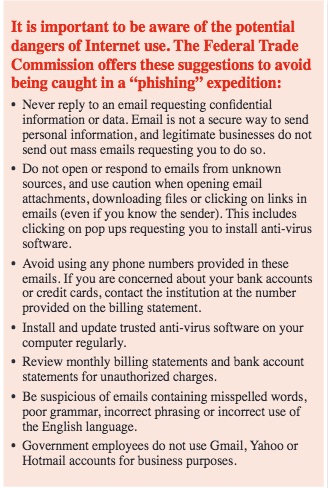

One common Internet scam involves “phishing,” which is “the activity of defrauding an online account holder of financial information by posing as a legitimate company” such as a reputable financial institution, credit card company or charitable organization. Phishing emails often contain a message that an account with the entity has been frozen or some error has been discovered that requires them to provide personal and/or confidential account information immediately in order to correct the problem. Personal information provided is transmitted to a fraudulent email account held by a cyber criminal.

According to the Internet Crime Complaint Center, seniors are particularly likely to fall for phishing scams in which the crooks claim to be a government employee with the IRS, FBI or Medicare. The seniors may be asked for personal information in order to process a tax return or return money that has been recovered on their behalf. In 2011, the Internet Crime Complaint Center received 14,350 complaints about emails falsely claiming to come from a government agency. The total amount lost was $3.5 million, with $2.2 million of this belonging to adults 50 years and older.

One of the newer phishing email scams revolves around the popular “my Social Security” account introduced by the Social Security Administration (SSA) in 2012. The scam in-volves a fraudulent email claiming to be from the SSA, ask-ing seniors to sign up for an account with the (fraudulent) Social Security company, thus providing the criminals with their information.*

The number of Internet crime victims is difficult to determine. Many seniors do not report the crime either because don’t want to admit they have been scammed or perhaps for fear of losing independence. Others may not even be aware that they have been victims. The Internet Crime Complaint Center says it received nearly 315,000 fraud complaints in 2011, resulting in a total loss of approximately $485 million.

If you think you’ve been a victim of Internet Fraud, report it on the Federal Trade Commission’s Identity Theft website at www.consumer.gov/idtheft. You may also forward any sus-pected phishing emails to: phishing-report@us-cert.gov.

Resources:

Anti-Phishing Working Group website http://www.anti-phishing.org

Federal Trade Commission, OnGuard Online Phish-ing Quick Facts at http://onguardonlin.gov/phishing.html

*Senior Tech Daily: http://seniortechdaily.com/email-safety-new-social-security-phishing-scam-targets-seniors/